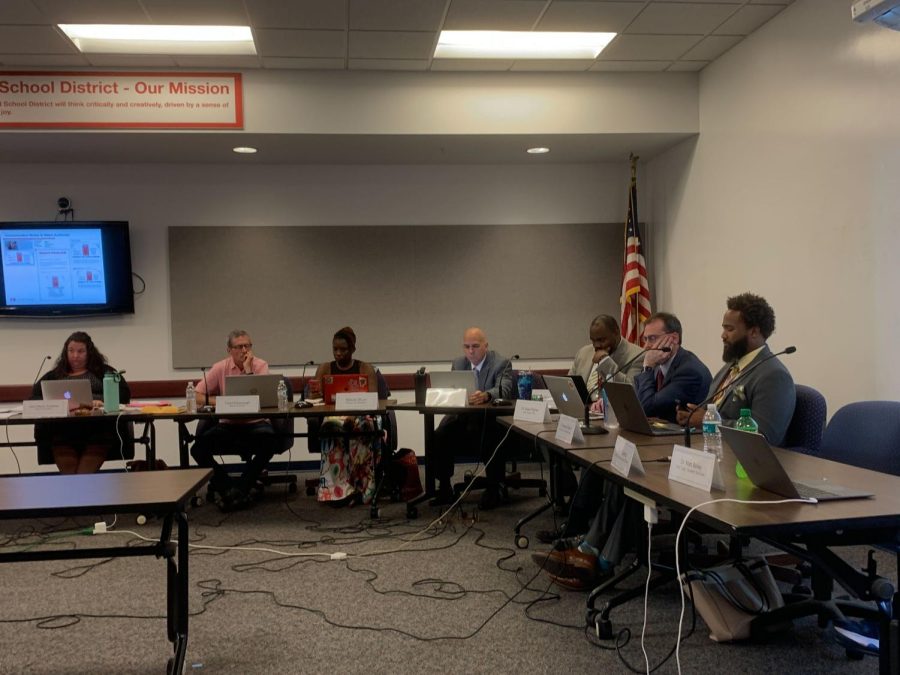

BOE discusses raising tax rates

The BOE discussed raising tax rates at the Sept. 19 hearing.

At the KSD Board of Education tax rate hearing Sept. 19, Mike Romay, KSD CFO, proposed increasing the residential tax rate 2.4 cents. The rate will be affected by the money KSD has recouped, which was just recently approved by the state auditor, according to Romay.

The tax rate is a home’s assessed value, which is 19% of home value, divided by 100 and multiplied by the tax rate, 2.4 cents, Romay said. There was a required decrease in residential, commercial and agricultural tax rates last year in order to comply with the state’s Hancock law. The Hancock law requires the state to refund money to income tax payers when revenues are in excess of a percentage based upon the personal income of Missourians. This decrease was based on assessed values from St. Louis County, which were incorrect. This year’s proposed tax increase is to recoup last year’s lost money. It would set the tax rate at the 2022 authorized tax rate ceiling.

“This is a non-reassessment year, so there won’t be any changes due to reassessment,” Romay said. “The only revenue the district will receive this year is from new construction and recoupment.”

Your donation will support the student journalists of Kirkwood High School. Your contribution will allow us to purchase equipment and cover our annual website hosting costs.

She/Her

Hobbies and Interests: lacrosse, shopping, Taylor Swift, reading

Favorite movie: 10 Things I Hate About You

Favorite Quote: "I love...

She/They

Hobbies and Interests: music, art, reading, collages

Favorite song: Mona Lisa by Mxmtoon

Favorite Quote: "We cannot become what we...